- July 28, 2019

- Posted by: SportsV

- Categories: Case Studies, Features, Home News, Industry News, News, Press Releases

In this latest case study, which is actually the first three articles of a seven part series, industry expert Mike Guiffre analyses what clubs, teams, stadia, arenas, leagues and federations can be doing in order to tackle the problem of declining attendances at their venues.

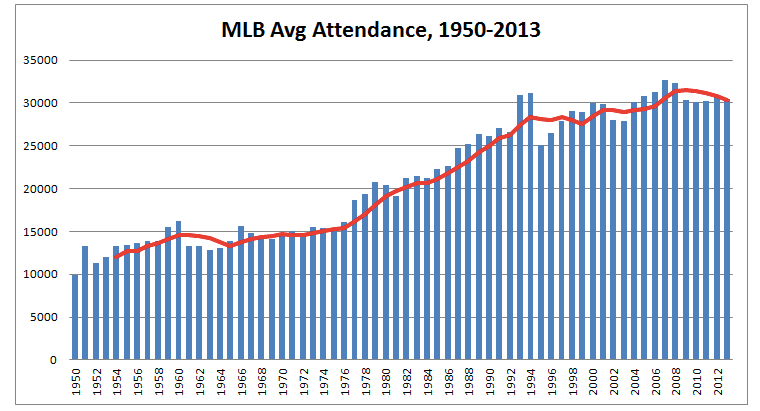

There has been a lot of media focus on the declining attendance of MLB recently, some fair and some not. And while attendance is sliding, it is hardly an MLB only issue, other than it being the most visible due to large stadiums and the number of games. Many leagues, teams, concerts and events are struggling to sell tickets as well.

You can look at many data points across the sports business landscape and see a myriad of varying conclusions as to why:

- Ticket price

- Ancillary costs

- A changing consumer landscape

- The ability to watch from home on a sick, affordable flat screen TV

- *gasp* Those evil millennials

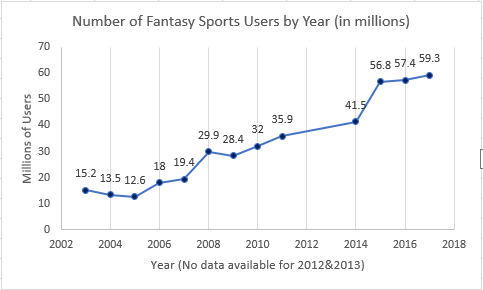

However, a lot of those data sets either do not tell the entire story and point to why attendance should be increasing and not the other way around. It is possible tomaximize revenue by creating scarcity with affordable tickets. You can manage brokers strategically. Millennials, ironically, covet experiences amongst many other false assumptions. TV/Content drives attendance through brand awareness. And lastly, Fantasy Sports and Gambling are driving even more marketability and awareness.

The data points to more consumer interest. So why are ticket sales failing, and how can we quickly address it? Let’s examine five reasons why and define strategies to help. Plus, two sports business relatable bonus tracks on customer LTV and innovation using real-world examples:

- Create Scarcity

- Find Solutions to Real Problems

- Embrace Modern Content

- Market Specific Resale Strategies

- Non-Revenue Shared Operating Income

Bonus Tracks:

Innovation goes Beyond Tech: What Sports Business can Learn from Sheetz

Customer LTV: What Sports Business can Learn from Buick and Toyota

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Article 1: Scarcity (Pricing Strategy) and Maximizing the Interest Curve

I wrote about this prior, but it may be the most critical aspect of the current landscape. The core issue with the existing retail pricing strategy is not taking advantage of our prime selling times as we overprice early due to revenue FOMO.

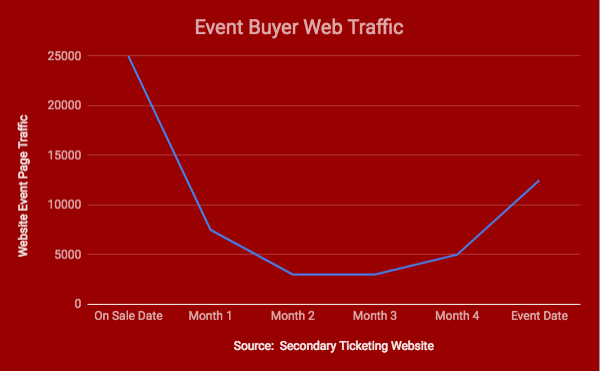

The feeling is that if we under price and sellout revenue is left on the table. We then combine this strategy with last-minute price drops, which in turn devalues our best customers. I don’t think $5, $10 or $15 flash sales are a terrible idea. To the contrary. There are just better ways to manage the effectiveness of a long-term strategy. Check out this graph below from the original article:

The higher interest times come early and pick up again late. If we overprice at on sale, there are too many tickets available leading up to the event and not enough interest to move them all.

The overpricing creates supply which has trained fans to wait out the market. The more inventory, the likelier we are to see a price drop closer to the event. While MLB has a disadvantage because of the sheer number of games and tickets to sell, other leagues and sellers can run into similar problems. Concerts, for example, have difficulties with no customer base and unique needs in each market. It is a daunting task and very difficult if you miss the on sale.

The original planning does not take into account the high costs of staffing and marketing needed to move any product over many months. By missing high-interest times, we are setting ourselves up for failure. The fix is to manage the inventory better.

We can utilize our tech infrastructure to sell earlier. Define how many seats you can sell early for the $10 to $15 range and manage the specific sections. I would recommend heavily targeting families, groups, military, and students for better target marketing and quality control. You can also openly market these within the parameters without compromising your corporate or season ticket base.

You can stop the potential resale of these tickets by utilizing technology and implementing strict policies. Once you have limited supply, you can more effectively manage a sales, marketing, and broker strategy.

The revenue maximization comes in with a higher value of the remaining tickets due to lower supply (exceptionally high demand games), increased ancillary spends by the consumer, and savings from further internal efforts.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Article 2: Stop Creating Solutions for the Wrong Problems

Suite sales are not dying. Millennials are not social but like sports.

One of my biggest pet peeves in the industry is over time we have made too many assumptions. We have more data and infrastructure than most other industries. However, the ideology and copy cat aspect of ticketing strategy can lead to poor decision making and long term planning. Let’s take a look at two examples:

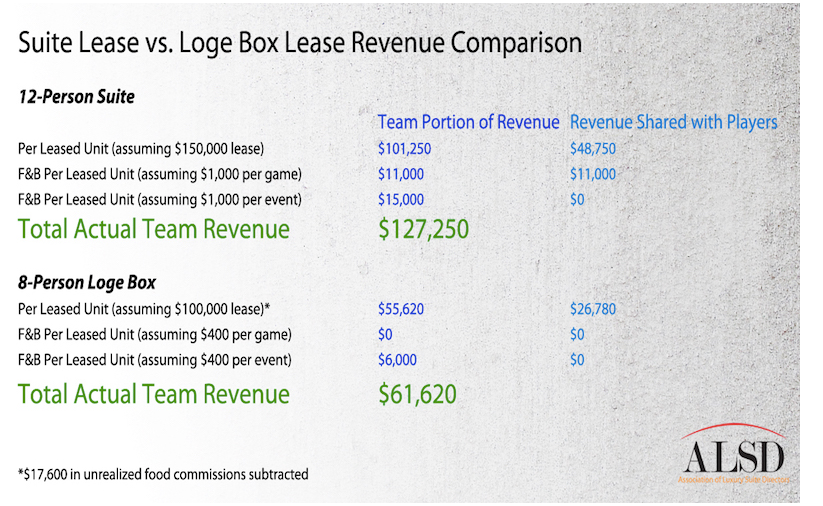

- Suite sales are not dying. They are as strong as ever. The market has simply shifted. A full season lease may be harder for various reasons such as more events, the tax law, or businesses merely becoming savvier and more budget consciences.

- That does not mean we need to make wholesale changes to our industry. It only means we need to work harder and smarter. The current solution I am referring to is the shift from suites to smaller all-inclusive areas. These sell for less revenue, include more expenses, and drive almost zero ancillary spends as they are all-inclusive.

Myself, along with Jared Frank, EVP at the Association of Luxury Suite Directors, took an in-depth look at these renovations. While some make sense in older buildings that overbuilt suites, cutting out revenue and more specifically non-revenue shared income (see article #5) can have adverse long term effects. Just as we are training customers to wait, we are teaching our corporate customers to spend less.

The real solution is to strategize, market, and sell suites better. Creating cheaper products with less spending capabilities that are easier to sell is building a solution for the wrong problem and potentially harmful long-term.

The second misconception is pretty much anything strategized to Millennials or Generation Z when it comes to ticketing, including social areas or subscriptions. The reality is we are missing a golden opportunity as Millennials, and younger generations covet experiences to the tune of 4 times the spending compared to a decade ago. The difference is Millennials want uniqueness through FOMO, not the social aspect.

Eventbrite and McKinsey both did studies involving the younger generations and live events. While the results are not surprising, the way the entertainment industry has reacted to them is.

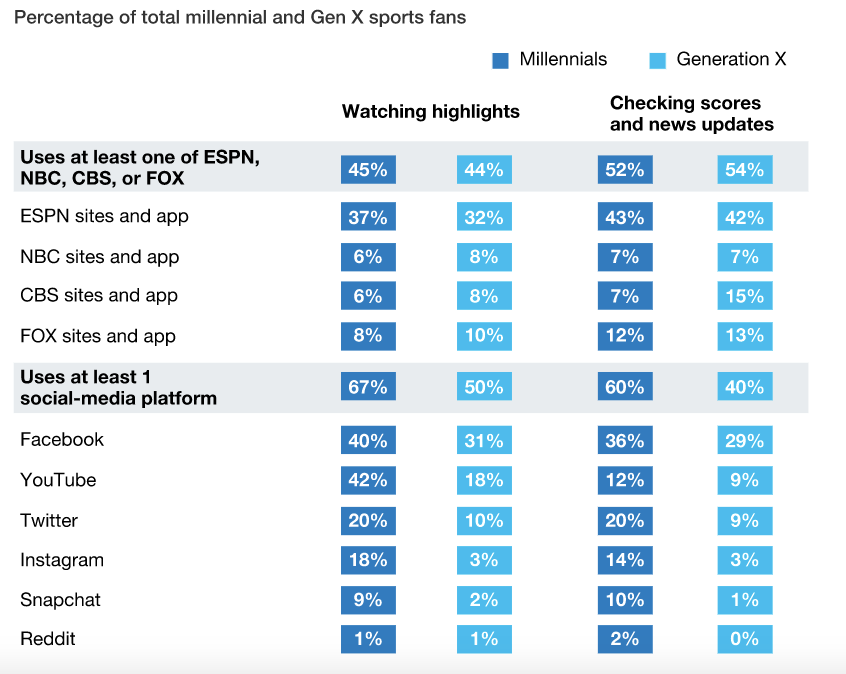

From the McKinsey article, Millennials consume about as much sports content as Generation X, just in a different and more readily marketable fashion (Digital and Social Media).

Yet, we have not changed our strategies enough to align with how the secondary ecosystem can aid in this fashion (see article #4).

- Millennials and Generation Z are not social. How anti-social are they? They do not communicate in person and before getting married all but stopped having sex. Our solution is to create and market social products they do not want in fashions they are not interested in receiving. Such as over the phone or generic messaging.

- Millennials are not teenagers anymore and are becoming parents. 53% of Millennials have children. That’s right, and we have a tech-savvy generation of Dad’s with smartphones, smartwatches, white sneakers, and khakis out there. So, Instead of creating innovative, frictionless, unique, or family-friendly products for them, we market areas that are none of the above. For example, my family and I attended a game in a social space as part of a workgroup. We had cheap tickets, a good view and an excellent experience except for one complaint. It was not suitable for children due to alcohol use by other guests. The usher warned us before the game even started. The product is right for some, but not all. The marketing should reflect that based on readily available data.

The solutions? Social areas are fine for those who want them. Same with subscriptions. However, those should be treated as tools to reach a small segment of fans.

For individuals who are not social? Who have young children? Do what the data says to do. Create unique, family friendly products through a frictionless experience. Then utilize technology and market what they want to them where they are. Hint: online begging for content.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Article 3: Content is Your Friend. Even TV.

Piggybacking on Article #2 and misconceptions, we have had a similar four-decade-long issue regarding content. Years ago the big misconception was that TV broadcasts were hurting attendance. It was a foregone conclusion for many executives. The biggest problem was the complete opposite had happened. Nobody bothered to check.

The more exposure, the more sales. Broadcasting games live on TV was the equivalent of someone paying you to advertise your product. Short of online infrastructure revolutionizing ticket sales, live broadcasts have been our biggest ally.

It is similar now with the excuses we read as to why attendance is down. Digital is not hurting attendance, and it is creating more loyal fans. Fans crave experiences and are more engaged than ever because of the online “tools.”

Engaged, you say?

To the tune of 16.7 billion online engagements in 2017 for the top 6 US professional sports leagues alone (NFL, MLB, NBA, NHL, MLS, NASCAR). TV viewership grew over time, but these engagements can drive revenue, especially combined with the targeted advertising potential based on the users online profile.

Even Millennials are still fans. How many in the business know that MLB is the 2nd most popular professional sport not just overall but for Millennials as well? According to McKinsey, there is only a slight drop in fandom between Generation X and Millennials for some sports and increases in others:

We still have a ton of fans (*cough* Customers) and have the unique opportunity to engage with them 24/7. The customer craves it: Did you know that sports fans are 67% more likely to use Twitter to enhance their experience?

While some leagues shied away from digital content to protect broadcast rights, overall, we see a pretty significant shift in strategy. The NHL even hired a twitter personality who made a GIF of goals in real time to work exclusively for them as they should.

I would need a separate article or series entirely to analyze and create an in-depth content strategy. And most leagues are starting to embrace this. However, when you sit down to map out your strategy if nothing else remember these four things:

- The more content you have that is engaged with, the better online profiles are created for your partners (both primary and secondary) to market to. Consider additionally working in a strategy to combine data and utilize other platforms to automate marketing messages up-selling individual tickets buyers based on their profile.

- We have the unique ability to market 24/7 to customers who want and engage in the content. Let’s not squander that opportunity.

- While it is common advertising practice now, in ticketing, we have an advantage over other advertisers because of the customers increased engagement. We have much better data through positive, relevant content. We can target even more accurately based on a genuine personal profile and not demographic data, which is only a slight indicator of purchase intent.

- Do not make assumptions. Listen to what the data is telling you and use it to drive ticket sales.

For series 4-7, go to: https://medium.com/@mikeguiffre/editors-note-this-is-article-of-1-of-the-7-part-series-2cb606fe612

For further information, contact Mike Guiffre via email at: mjguff@gmail.com or follow him on Twitter at: @mjguff

Main image (top), Photo Credit: Ken Cooper

ALSD International – Europe’s one and only event dedicated to the Premium/VIP/Club Seat & Hospitality sector – is coming to Croke Park Stadium this October, where speakers from across Europe and North America will be providing insights on how to increase revenues through new builds, renovations and service expansions, as well as via the latest F&B and technology offerings.

#ALSDInternational – Europe’s leading event dedicated to the Premium/VIP Seat & Hospitality sector

#sportsvenuebiz

#sportsvenuebusiness – the world’s leading platform for sector news views & developments