- May 2, 2019

- Posted by: SportsV

- Categories: Case Studies, Features, Home News, Industry News, News, Press Releases

A new study from multi-discipline brand design consultancy, Harrison, and data experts, CGA, has revealed that UK sports venues are falling short of customer expectations, failing to keep up with changing consumer habits and lagging behind the rest of the out-of-home food and drink market.

According to the study, when it comes to food and drink, more than half of consumers rated the offering as either ‘okay’, ‘poor’ or ‘awful’.

The research – which pairs CGA’s knowledge of Britain’s eating and drinking-out market with Harrison’s expertise in hospitality architecture, design and branding – provides much-needed analysis of the current food and drink provision in major sporting venues across the UK and suggests there is a significant opportunity to drive the experience for, and spend from, an affluent audience.

The in-depth study also reveals that of the 12.1 million British adults who have visited a major sports arena in the last 12 months, as many as 70% are male and nearly 60% are white-collar workers. Their average monthly eating and drinking out spend is £113.48 – 27% more than the national average – and half of them (51%) drink out weekly, compared to a third (33%) of the wider adult population.

Over 54% consider themselves to be foodies, against a national average of 49%, and more than two in three (71%) say they take a keen interest in food and drink.

What’s more, 68% of stadia consumers say they proactively try to lead a healthy lifestyle and 69% attempt to live in an environmentally-friendly way.

Despite having more disposable income, 42% of consumers cited expensive food and drink as their biggest frustration when visiting stadia, with 38% citing lengthy queues as a common annoyance, and one in five (18%) saying poor Wi-Fi service is a big irritation.

Commenting on the results, Philip Harrison – one of some 60-plus expert speakers that participated in the 2018 edition of ALSD International – Founder at Harrison, said:

The findings from this report indicate three very clear demands from consumers: better quality of food and drink, better value and better service.

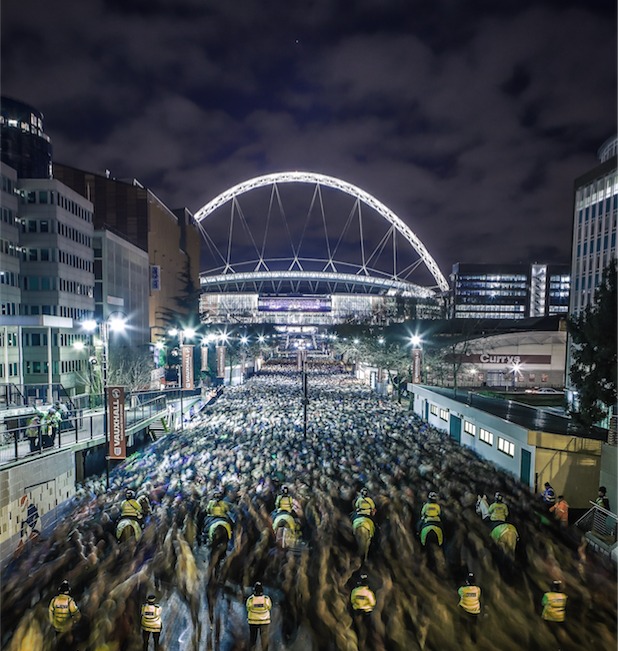

Some stadia – for example, Wembley and the new White Hart Lane, or Carrow Road in Norwich – are leading the way when it comes to expanding and diversifying their F&B offerings, but many venues have not kept pace with the evolution in out-of-home eating and drinking, and are falling well short of their customers’ expectations. In the US, arenas are typically some way ahead, their stadia events can be an all-day affair and clearly there are best practises that need to be reflected in the UK.

Stadia operators, planners, retailers and creators must meet these changing consumer demands and expectations if they are to improve customer satisfaction and ultimately increase their sales in the years ahead.

Karl Chessell, Business Unit Director for Food and Retail at CGA, said:

This report highlights the huge potential for stadia to increase their food and drink sales. The data shows that consumers have money in their pockets to spend on snacks, meals and drinks as part of their day or evening out—but it is all too often a time-consuming, expensive and poor-quality experience. With more than two thirds of stadia-goers considering themselves knowledgeable about food and drink, it is clear that menus, service and value in many venues are simply not good enough yet.

But the research also shows that things are changing. Forward-thinking stadia in the UK and US, as well as dynamic casual dining and bar brands, show how it is possible to make eating and drinking out compelling and memorable, and technology is adding exciting new ways to improve engagement and efficiency even further. By understanding the key trends and learning from others, all stadia operators can make food and drink a bigger part of their revenues.

Full white paper available on request via https://www.harrison.hn/stadia/

Main image (top) of Wembley Stadium: Some stadia – for example, Wembley and the new White Hart Lane, or Carrow Road in Norwich – are leading the way when it comes to expanding and diversifying their F&B offerings

Images, courtesy: Harrison / CGA

Increasing revenue and the premium customer experience through the latest offerings in F&B and technology, as well as via new builds, renovations and service expansions, is the key focus of ALSD International – Europe’s leading event for the Premium Seat & Hospitality sector – which brings together industry experts from across Europe and North America to share their insights with other clubs, federations, leagues, venues, etc.

The 60-plus speakers at the 2018 edition of ALSD International included Philip Harrison, Founder, Harrison, Charlene Nyantekyi, General Manager, Club Wembley, The FA Group, Tom McCann, Head of Premium Sales, Service & Operations, Arsenal FC, Andy Simons, Founding Director, KSS and Tyler Mazereeuw, Chief Revenue & Marketing Officer, Canadian Football League.

#SportsVenueBusiness – the leading platform for sector news, views & developments